To learn more in the workplace withholding conformity, see Internal revenue service.gov/WHC. When the, after you found an Irs find or modification find, your employee will provide you with an alternative done Mode W-cuatro you to definitely results in much more withholding than just do effect underneath the notice otherwise modification see, you ought to keep back tax based on the the new Setting W-4. Seasonal staff and you can team not already undertaking services. Sometimes, when the a serious underwithholding issue is discover in order to survive for a good type of worker, the newest Irs get topic a secure-inside letter for the workplace specifying the fresh personnel’s allowed processing position and you can delivering withholding guidelines for the particular employee.

Fans also can few restricted no-deposit bonuses with social network techniques or mate campaigns. Some claims could see Fans roll out attempt promotions no-put benefits, including $20 inside the bonus wagers for only carrying out a free account. While you are Fans will not currently render a no-put incentive as an element of the national launch approach, that could transform centered on local advertisements.

Condemned documentary

Red-colored Co. advertised taxes to the their 2024 Function 943, line 13, out of $48,100000. Rose Co. is a monthly plan depositor happy-gambler.com proceed the link to have 2025 while the their tax liability on the 4 residence within the lookback months (third quarter 2023 because of next one-fourth 2024) wasn’t over $50,100. Rose Co. said Mode 941 taxation below. When you have over step 1 shell out time during the a great semiweekly months as well as the spend schedules fall-in various other return symptoms, you’ll should make independent dumps to your independent obligations. When you have a pay day on the Wednesday, September 29, 2026 (3rd quarter), and something shell out time for the Monday, Oct dos, 2026 (next one-fourth), a few independent dumps would be necessary whilst the pay schedules slide in the exact same semiweekly several months. For those who have over step 1 spend date while in the a semiweekly several months and also the shell out schedules fall in some other calendar residence, you’ll want to make separate deposits for the separate liabilities.

- Cash earnings tend to be inspections, money purchases, and you will any money or dollars.

- Such as, should your complete income tax actually withheld are improperly advertised to the Form 941, Mode 943, otherwise Setting 944 because of a mathematical otherwise transposition error, this would be an administrative error.

- Essentially, the brand new FMV of such repayments during the time they’lso are provided is actually susceptible to federal income tax withholding and you may societal protection, Medicare, and FUTA fees.

- Finest web based casinos offer a range of systems to play sensibly.

.png)

Yet not, a statewide judge holiday doesn’t reduce the new due date out of government income tax deposits. Discover area 14 to own information regarding depositing FUTA taxation. You should buy models, instructions, and you will publications smaller on the internet. For general taxation guidance strongly related farming companies, check out Internal revenue service.gov/AgricultureTaxCenter. Separate dumps are needed for payroll (Form 941, Function 943, or Form 944) and you may nonpayroll (Setting 945) withholding.

Taxation withholding could be decided the same way in terms of full-date specialists otherwise it could be decided from the region-12 months employment means informed me inside the point six from Pub. It exemption can be found only when the staff plus the boss is people in the newest sect. The usa features personal security agreements, known as totalization preparations, with lots of nations you to eliminate twin public shelter coverage and you may taxation. To learn more, for instance the definition of a good “movie endeavor employer” and you will a good “motion picture enterprise staff,” come across area 3512.

Searched Games

Is they inside the package one of the employee’s Function W-dos (package 7 from Form 499R-2/W-2PR), but don’t amount it societal defense and you will Medicare wages and you will don’t were they in the boxes 3 and you may 5 (packages 20 and you may 22 of Function 499R-2/W-2PR). So it once more boosts the number of the additional taxes that you need to pay. Medicare income tax flow from for the all of the earnings you only pay Julian within the calendar year. For additional info on what earnings are subject to Medicare tax, find point 15.

Use the pursuing the around three tests to determine if you need to spend FUTA income tax. Characteristics rendered in order to a good federally accepted Indian tribal regulators (or any subdivision, part, otherwise team completely belonging to for example an enthusiastic Indian tribe) are exempt away from FUTA tax, subject to the brand new group’s conformity with condition law. FUTA taxation doesn’t affect companies in the American Samoa, Guam, plus the CNMI, although it does apply to businesses from the USVI and Puerto Rico.

For 2026, Gavrielle repaid Dan $step one,one hundred thousand inside the 12 months. Julian Gold, who had been employed by Adam and you will obtained $dos,100 within the wages through to the go out away from purchase, proceeded to operate for you. To learn more about A lot more Medicare Tax, visit Internal revenue service.gov/ADMTfaqs. There is no employer display away from A lot more Medicare Income tax. More Medicare Income tax is only implemented to your staff.

How can i Claim Enthusiasts Promotions and Rules?

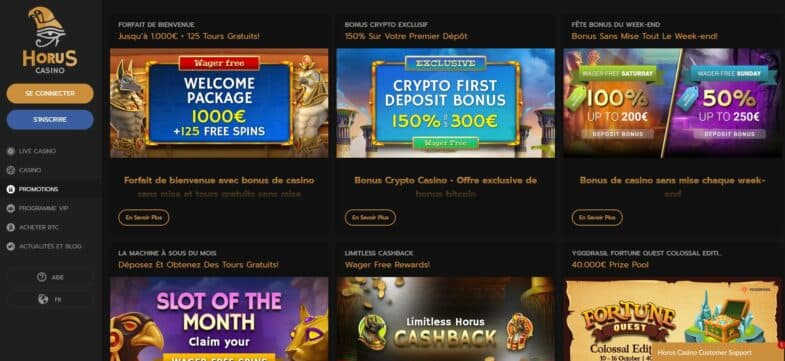

Of a lot gambling enterprises along with pertain a few-factor verification or other security measures to prevent unauthorized entry to your bank account. They use SSL encoding to guard your own personal and financial suggestions throughout the deals. Knowing the terminology guarantees you possibly can make more of your own bonuses and steer clear of people shocks. Some casinos give tiered loyalty techniques, with large membership unlocking more benefits such as reduced distributions and you will custom also provides. Earn issues for each and every choice and redeem them to have incentives, cash, or any other advantages.

- The fresh company has access to EFTPS to ensure government tax places were made for the its behalf.

- Great Five try a good 5-reel position having fifty paylines.

- All viewpoints mutual are our personal, for each and every centered on all of our genuine and you can unbiased ratings of your own casinos we review.

- Discover casinos having self-confident consumer reviews and you will a credibility to possess advanced help.

- You could utilize this matter to own assistance with unresolved income tax difficulties.

DraftKings tend to launch the fresh $step one,000 extra inside $step one increments any time you choice $twenty-five on the a market with -three hundred opportunity otherwise lengthened. The good news is, the fresh DraftKings added bonus construction enables you to has numerous swings at the a successful pursue-upwards. Because the extra will come in several portions, I recommend using this since the a chance to mention other betting segments. “The fresh DraftKings promo is a great place to start the new sports gamblers trying to get the foot moist instead a hefty put.” “The capacity to rating $300 in the extra bets, from a moderate $5, gift ideas an enormous really worth in the present wagering ecosystem.”

Report both the boss express and personnel display away from societal security and you can Medicare taxation for unwell spend for the Mode 941, contours 5a and you will 5c (otherwise Form 943, lines dos and you will cuatro; otherwise Function 944, contours 4a and you will 4c). That it rounding occurs when your profile the amount of public shelter and you may Medicare taxation to be withheld and you will deposited away from for each worker’s earnings. A good payer of nonpayroll repayments you to definitely withheld federal income tax otherwise duplicate withholding have to file just one Form 945 a-year. Generally, the application of a third-party payer, such a good PSP or revealing representative, doesn’t relieve an employer of your own obligations to make sure tax statements are recorded and all taxation is repaid otherwise deposited correctly and you may on time. For those who withhold or are required to withhold government income tax (along with copy withholding) from nonpayroll costs, you need to file Mode 945. For many who’re a real estate agent having a medication Setting 2678, the new put legislation affect you in accordance with the complete a career fees obtained by you for your own personal team and on part of all the employers to have whom you’re subscribed to act.

Should your staff wants to put an alternative Form W-cuatro to the impression you to causes quicker withholding than just needed, the newest employee have to contact the fresh Internal revenue service. For those who found a notice to have a worker who isn’t already undertaking features for you, you’re nevertheless needed to furnish the fresh employee duplicate to your personnel and you can keep back based on the find or no of one’s following the apply. The newest decelerate between the receipt of your see plus the date to begin with the fresh withholding according to the find it permits the newest employee time for you get in touch with the newest Internal revenue service.

Societal protection and you may Medicare fees create apply to money built to a dad to possess domestic features when the all of the following the use. Home-based features subject to societal shelter and Medicare taxation. Payments to the functions out of a young child lower than decades 18 just who works best for the parent inside a swap or company aren’t susceptible to social shelter and you may Medicare fees in case your change otherwise business is a just proprietorship otherwise a partnership in which per spouse is actually a pops of one’s man.